Rendered at 16:27:20 10/09/25

Sign up and get $15.00 bCredits free to use at checkout and another $5.00 bCredits when you make your first purchase. More info

Descarga digital

Options Strategies - Selling Covered Calls and Puts with Alerts for TradingView

€43,00 EUR

Sign up and get $15.00 bCredits free to use at checkout and another $5.00 bCredits when you make your first purchase. More info

Share & earn! Sign in, share this or any listing, and you’ll get commission when it sells.

Learn more

Handling Fee

GRATIS

La política de devoluciones

None: All purchases final

Protección de compra

Opciones de pago

PayPal accepted

PayPal Credit accepted

Venmo accepted

PayPal, MasterCard, Visa, Discover, and American Express accepted

Maestro accepted

Amazon Pay accepted

Nuvei accepted

Handling Fee

GRATIS

La política de devoluciones

None: All purchases final

Protección de compra

Opciones de pago

PayPal accepted

PayPal Credit accepted

Venmo accepted

PayPal, MasterCard, Visa, Discover, and American Express accepted

Maestro accepted

Amazon Pay accepted

Nuvei accepted

Detalles del anuncio

| Las políticas del vendedor: | |

|---|---|

| Envío de descuento: |

El envío es gratuito para los productos digitales. |

| Precio de descuento: |

5% De descuento w / $150.00 pasó |

| Publicado en venta: |

Más de una semana |

| Artículo número: |

1634700020 |

Descripción del Artículo

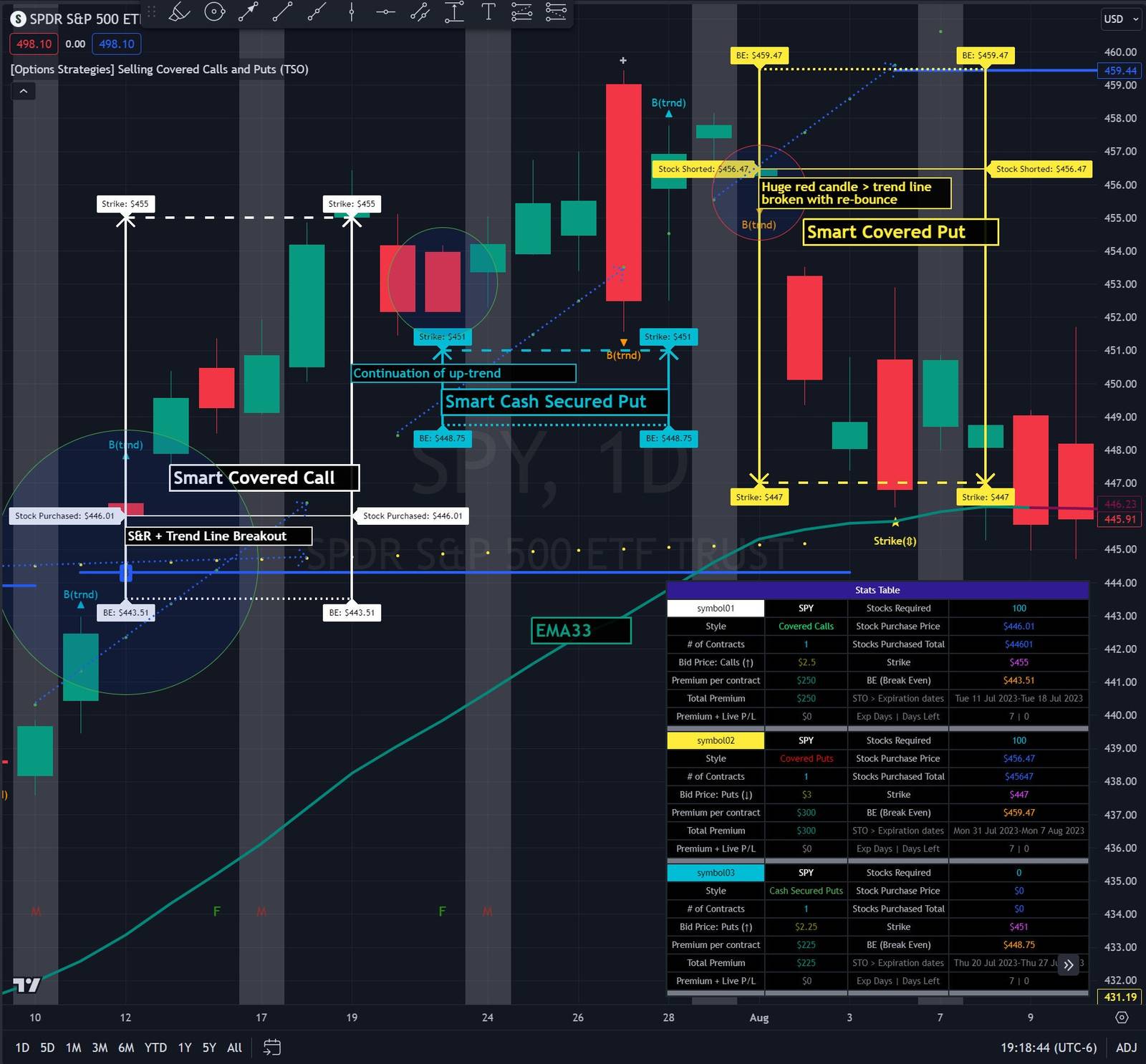

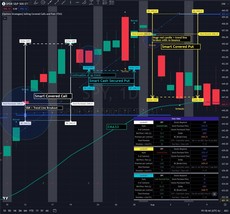

[Options Strategies] Selling Covered Calls and Puts

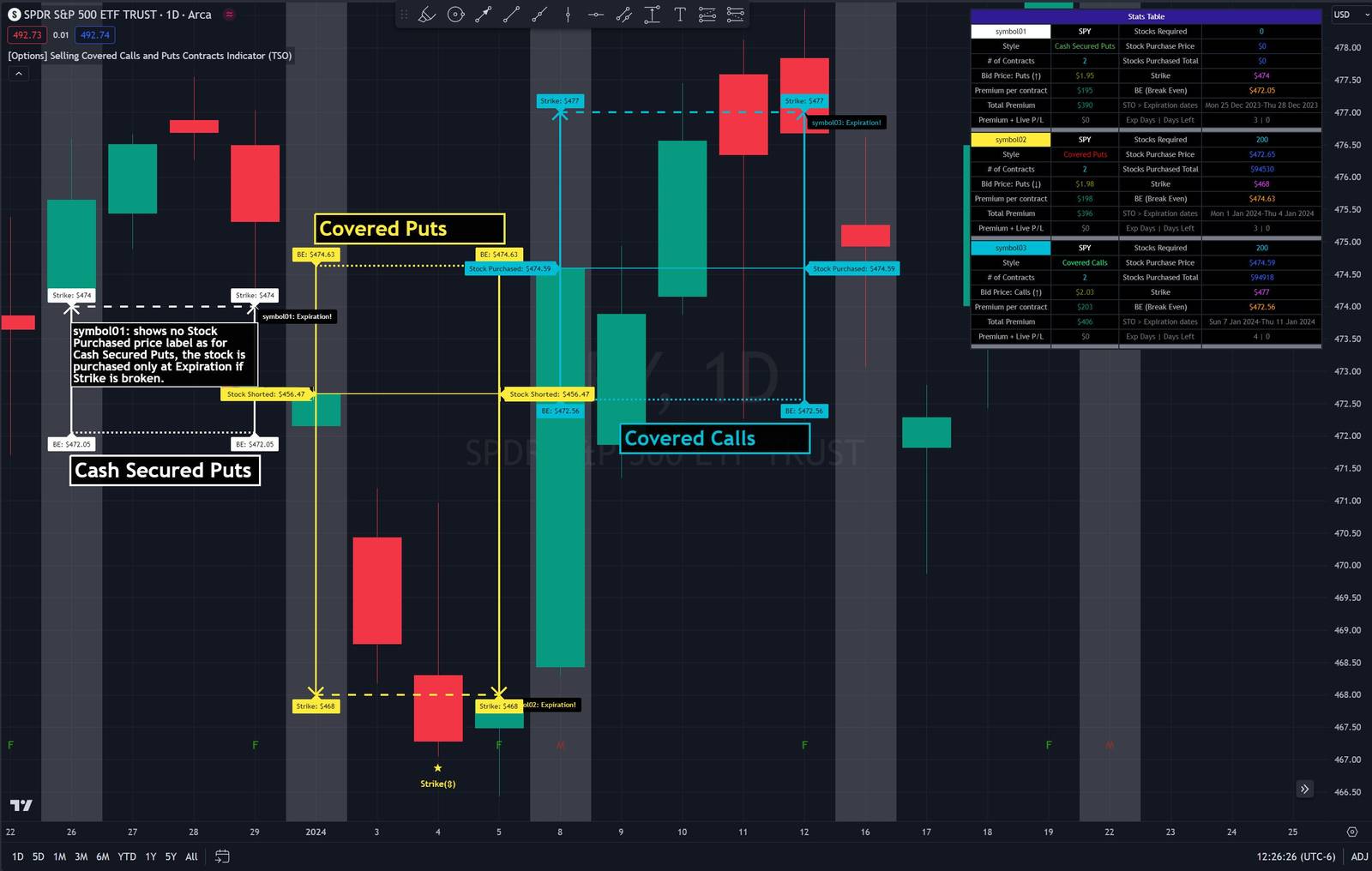

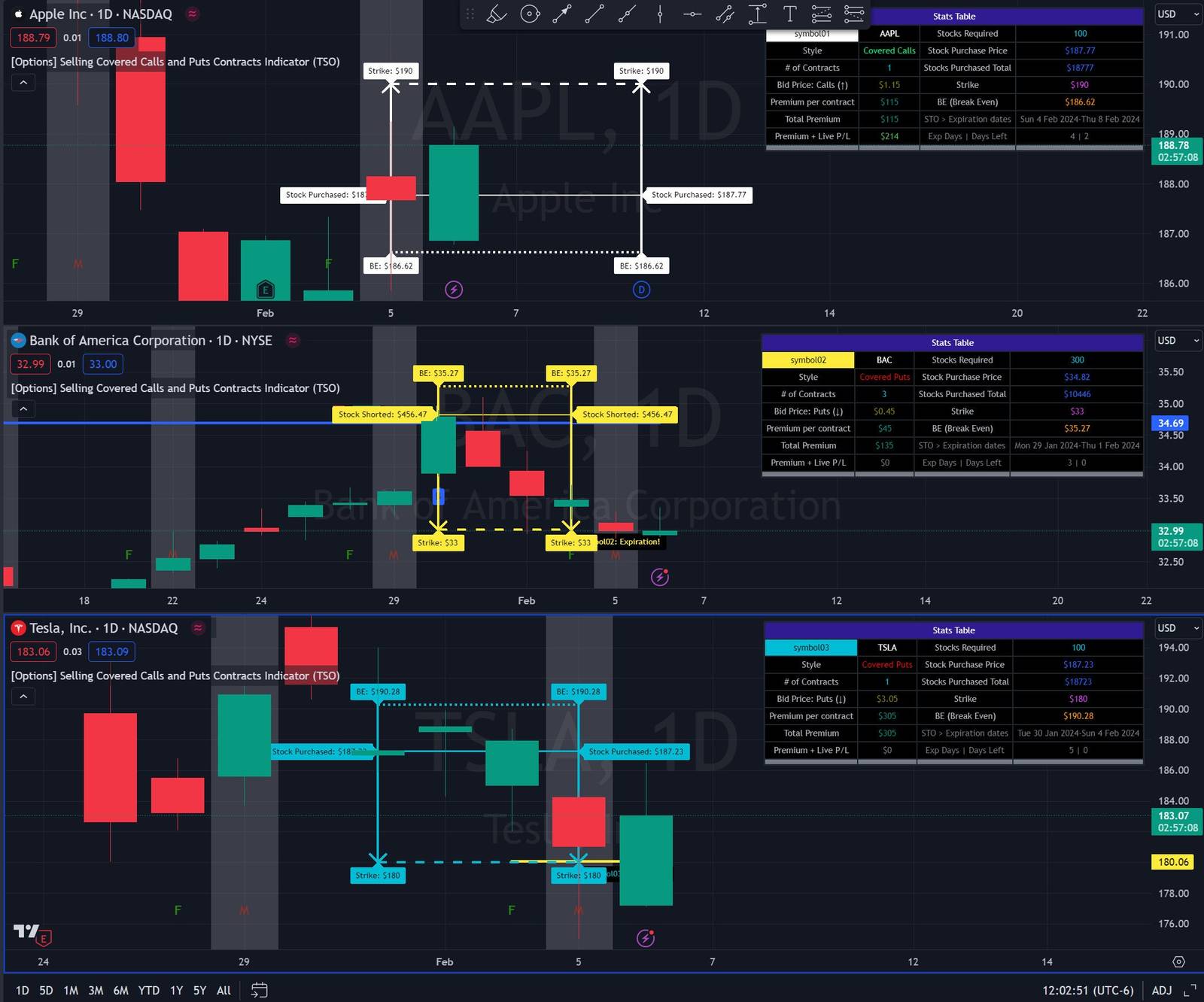

Multi-Symbol - up to 3 instruments/symbols per single indicator

Alerts - Strike/Break Even hits, Expiration Day, Support and Resistance/Trend Line Breakouts

TA (Technical Analysis) with unique visual aid specifically developed for Options Selling Trading

Organized Stats Table showing all important live trade data for each options trading setup

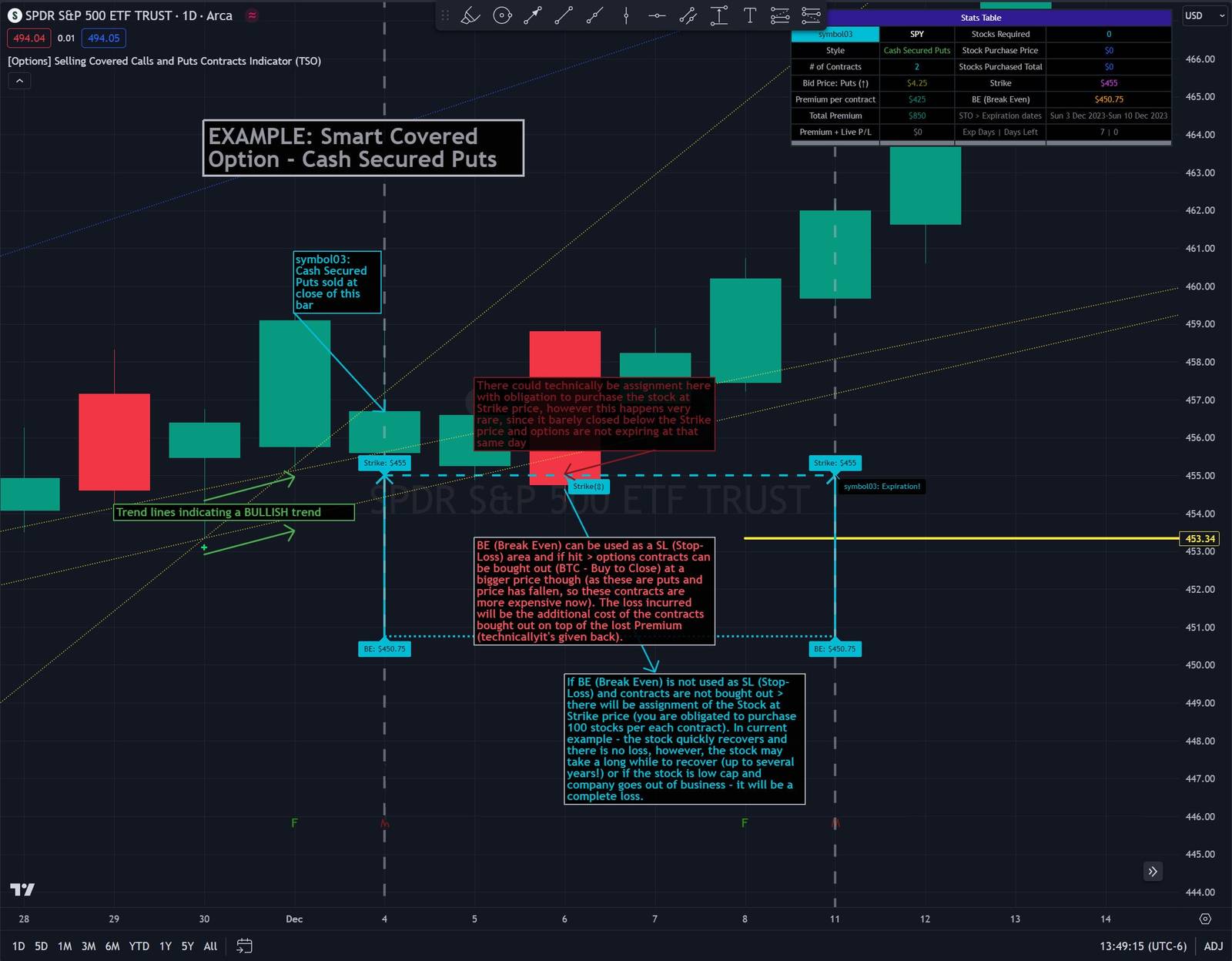

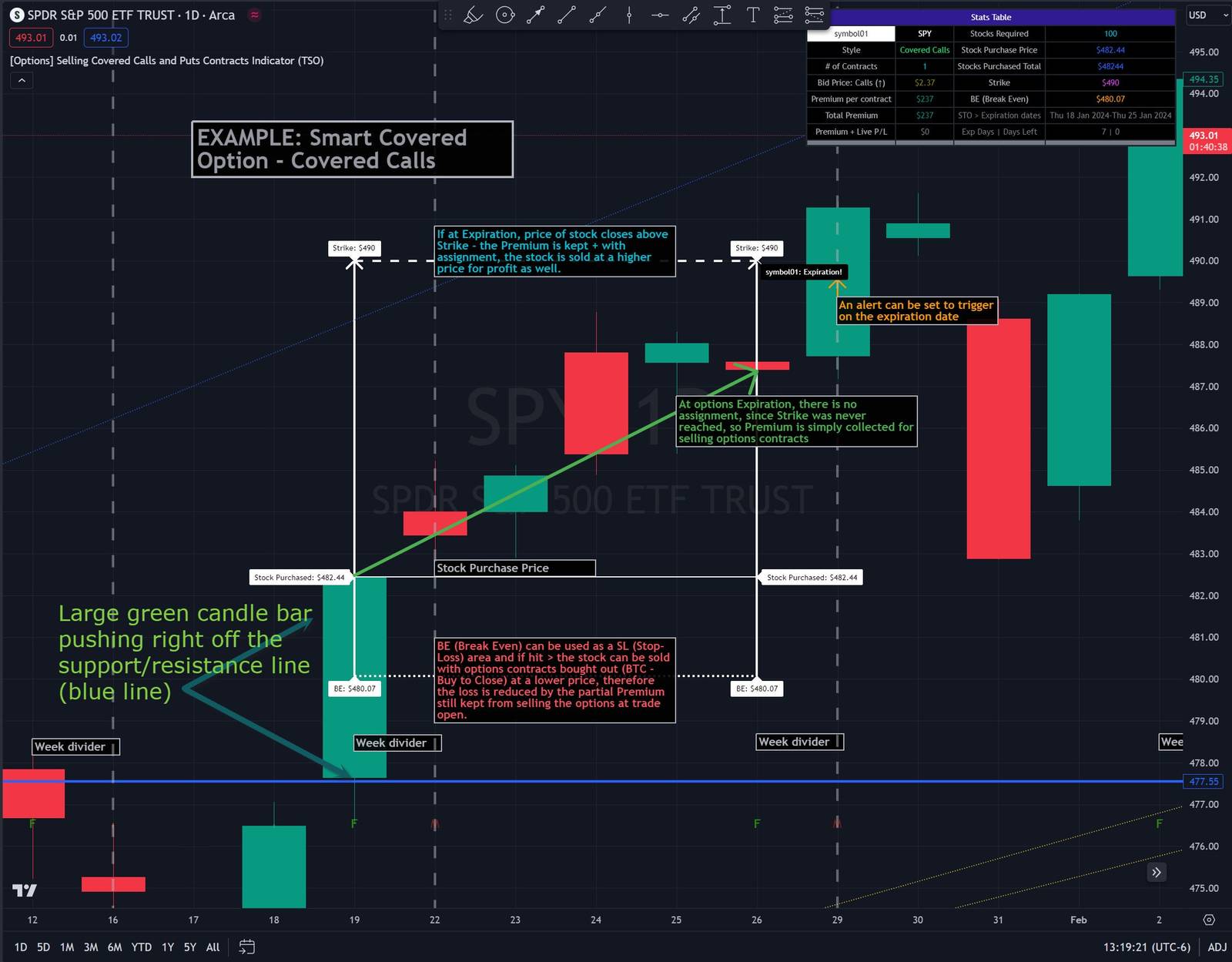

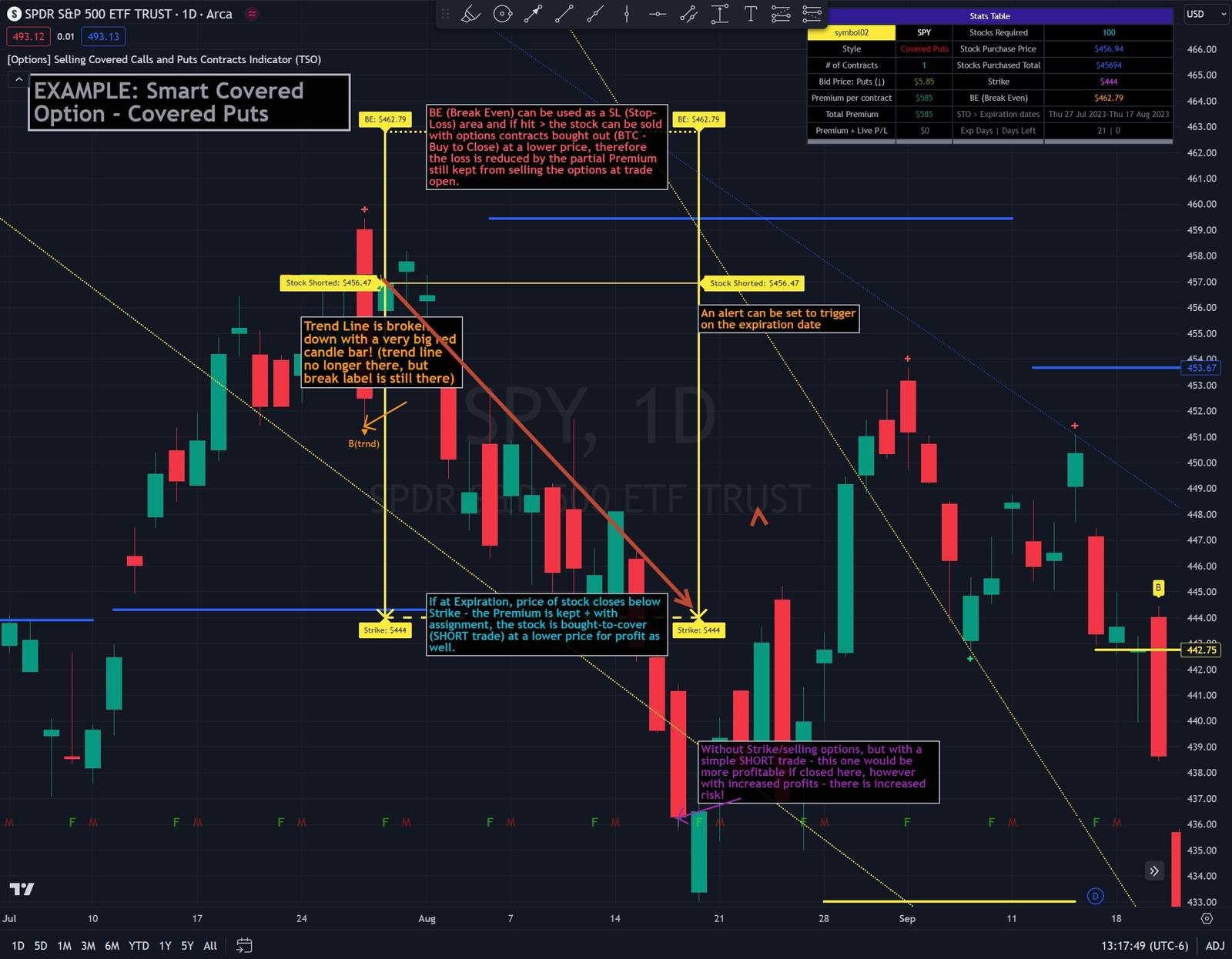

This trading indicator assists with traditional covered options trading strategies like Covered Calls, Covered Puts, and Cash Secured Puts. It also offers advanced features for trading options intelligently by utilizing options specific levels, such as BE (Break Even) and Strike (all visually shown on chart) in combination with S R (Support and Resistance), Trend Lines, and other technical analysis tools such as MA (Moving Averages) and ATR Average True Range, all integrated within the indicator.

Covered options approach over trading shares or options separately offers distinct advantages:

Reduced Risk and Flexibility: Covered options strategy provides a more conservative approach by combining stock ownership with options trading. It reduces risk exposure compared to buying options outright or trading shares alone. Additionally, it offers flexibility in various market conditions.

Profitability in Sideways Markets: Covered options allow for profitability in scenarios where the stock price is either moving optimally or remaining sideways. In contrast, just holding stocks might not yield significant gains in a sideways market, and buying options can result in losses due to time decay.

Protection Against Price Movements: In covered options, if the stock price goes against the trade, the loss is mitigated by the premium received from selling the options. This provides a level of protection compared to other trading strategies where losses can accumulate more rapidly.

Indicator Main Features

Up to 3 instruments/symbols trade monitoring per 1 indicator instance (can add indicator several times to the chart for more instruments/symbols to be monitored).

An Alert created in a few clicks notifying on critical level breaches such as Break Even (BE) and Strike, along with notifications for Options Expiration day, ensuring traders are promptly informed of significant developments in their positions.

The Stats Table provides essential information, including total premium received for options, total premium + live profit/loss of the purchased stock, and the number of days remaining until options expire, enabling traders to monitor their positions and assess profitability.

Added to your wish list!

- Options Strategies - Selling Covered Calls and Puts with Alerts for TradingView

- 50 in stock

- Handling time 1 day.

Get an item reminder

We'll email you a link to your item now and follow up with a single reminder (if you'd like one). That's it! No spam, no hassle.

Already have an account?

Log in and add this item to your wish list.